Learn. Explore. Pursue more.

Professional Investors Only (MiFID II Annex II).

eur/usd - 1.17201

who we are

We offer a software as a service High-Frequency Algorithm For The Professional Investor

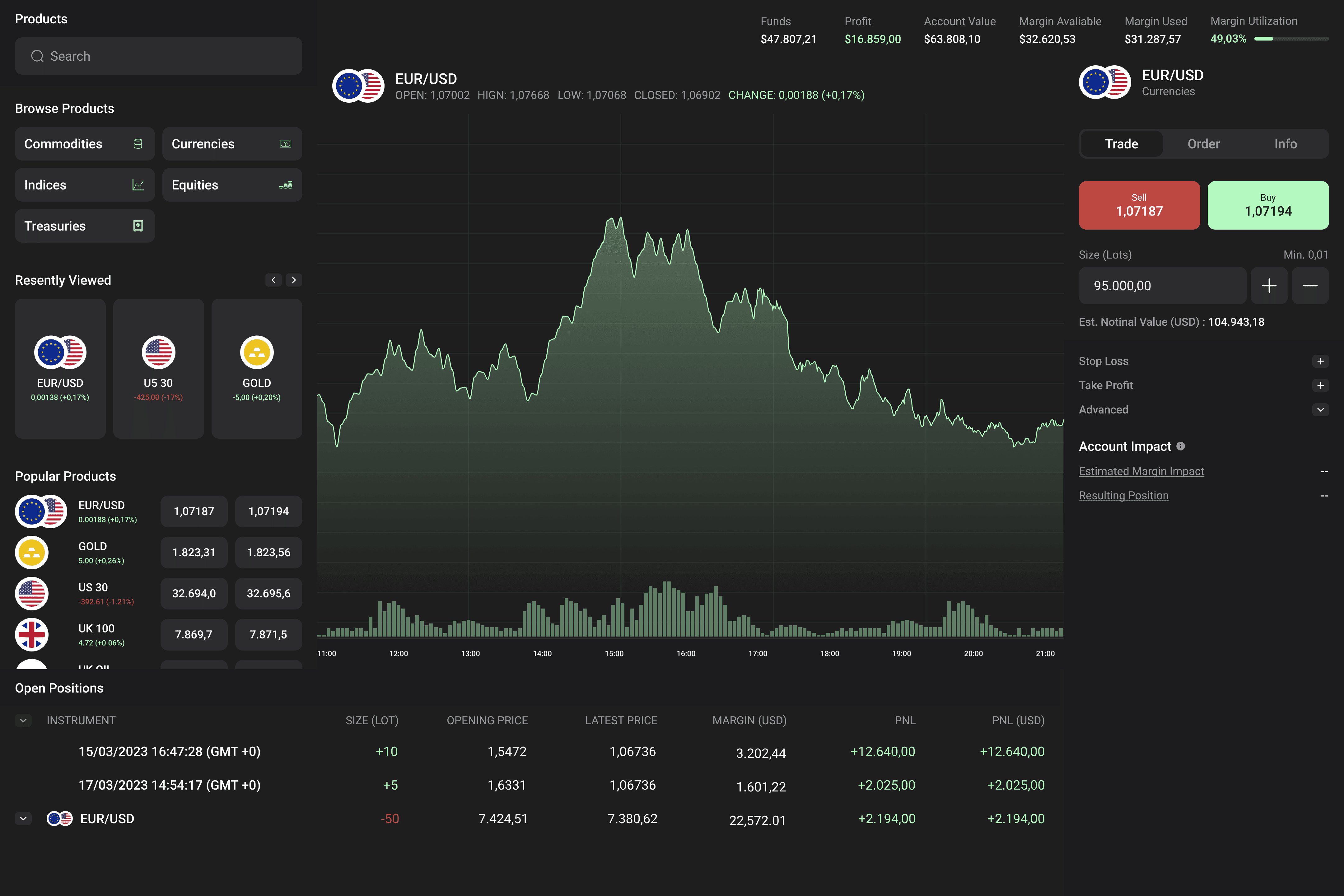

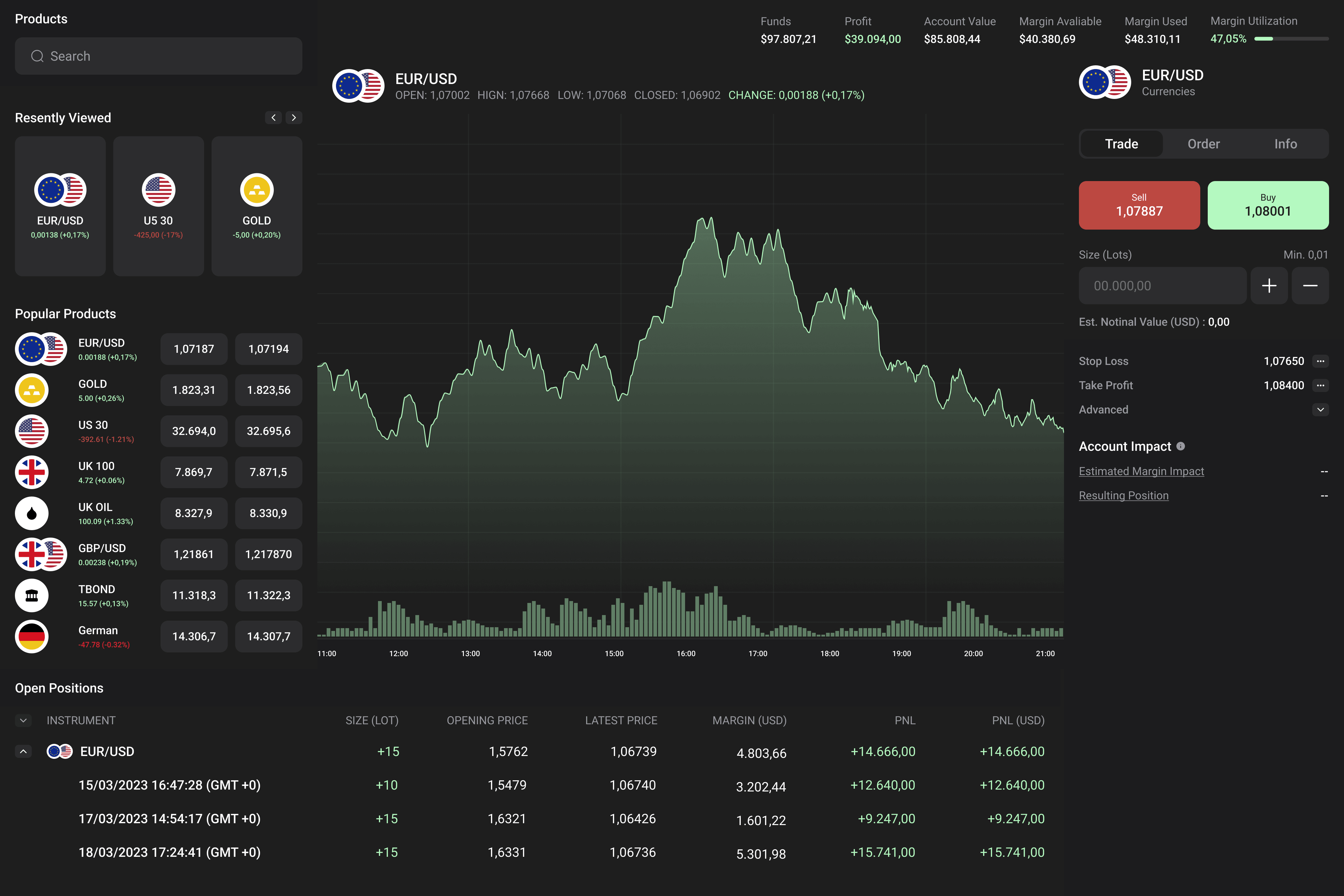

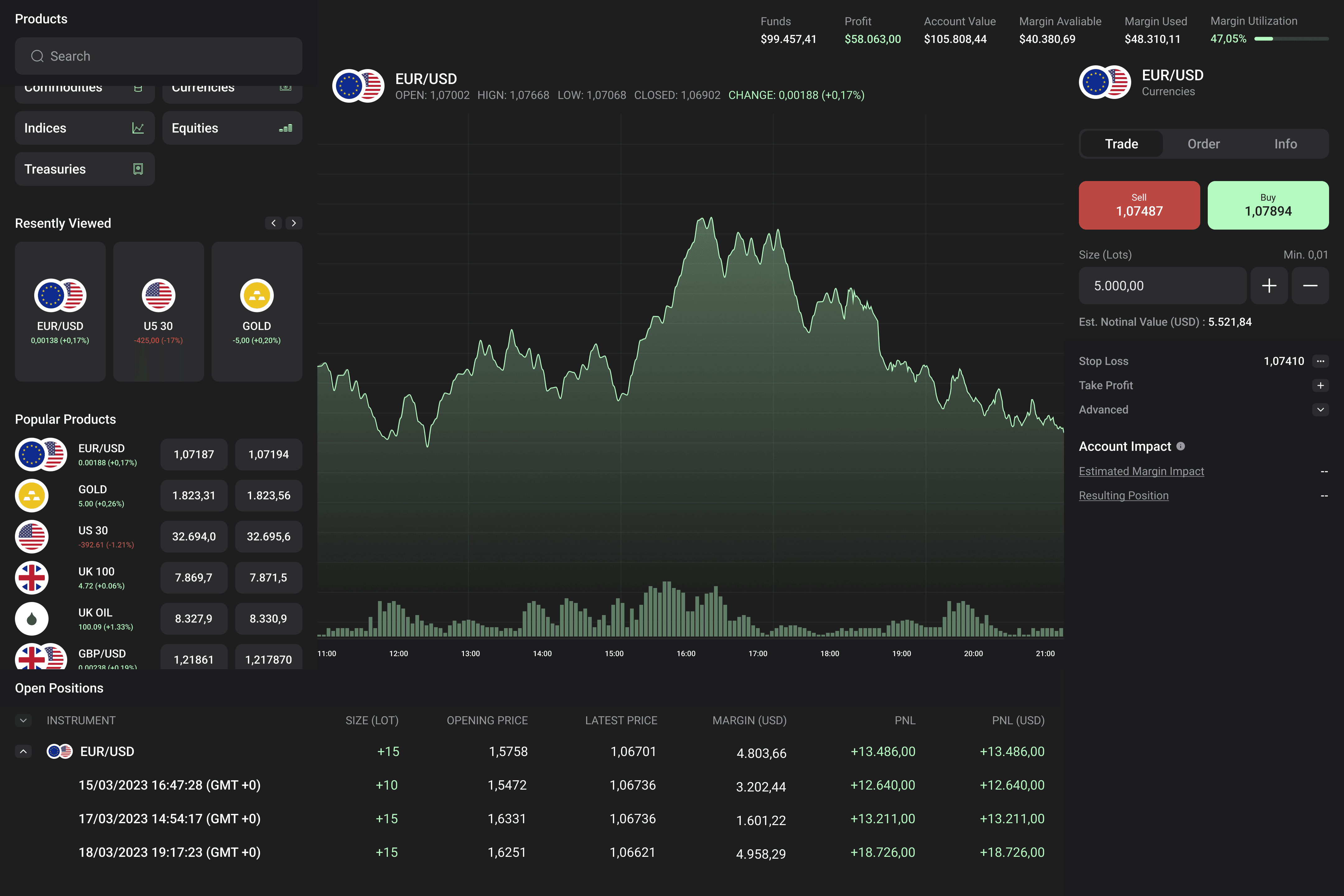

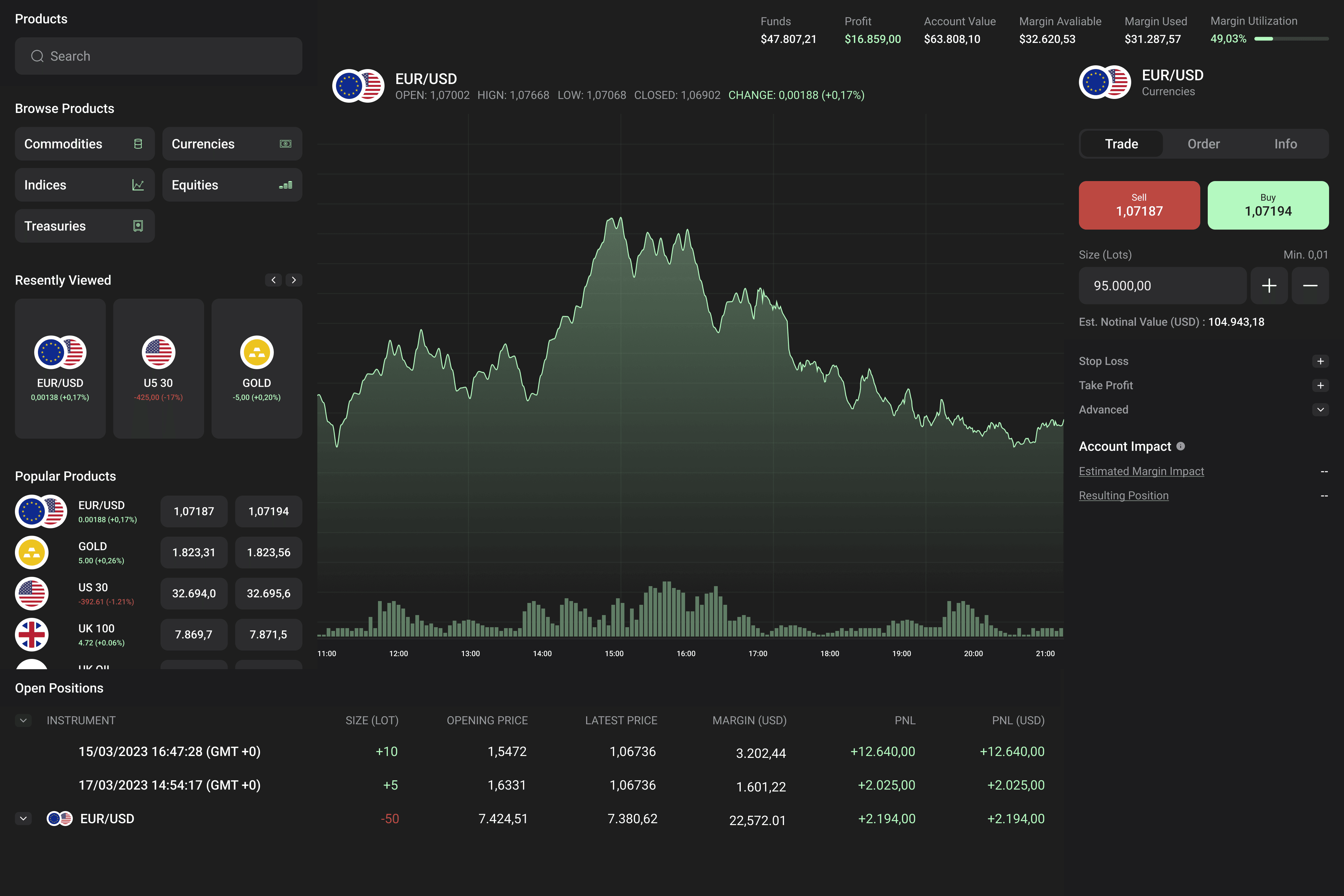

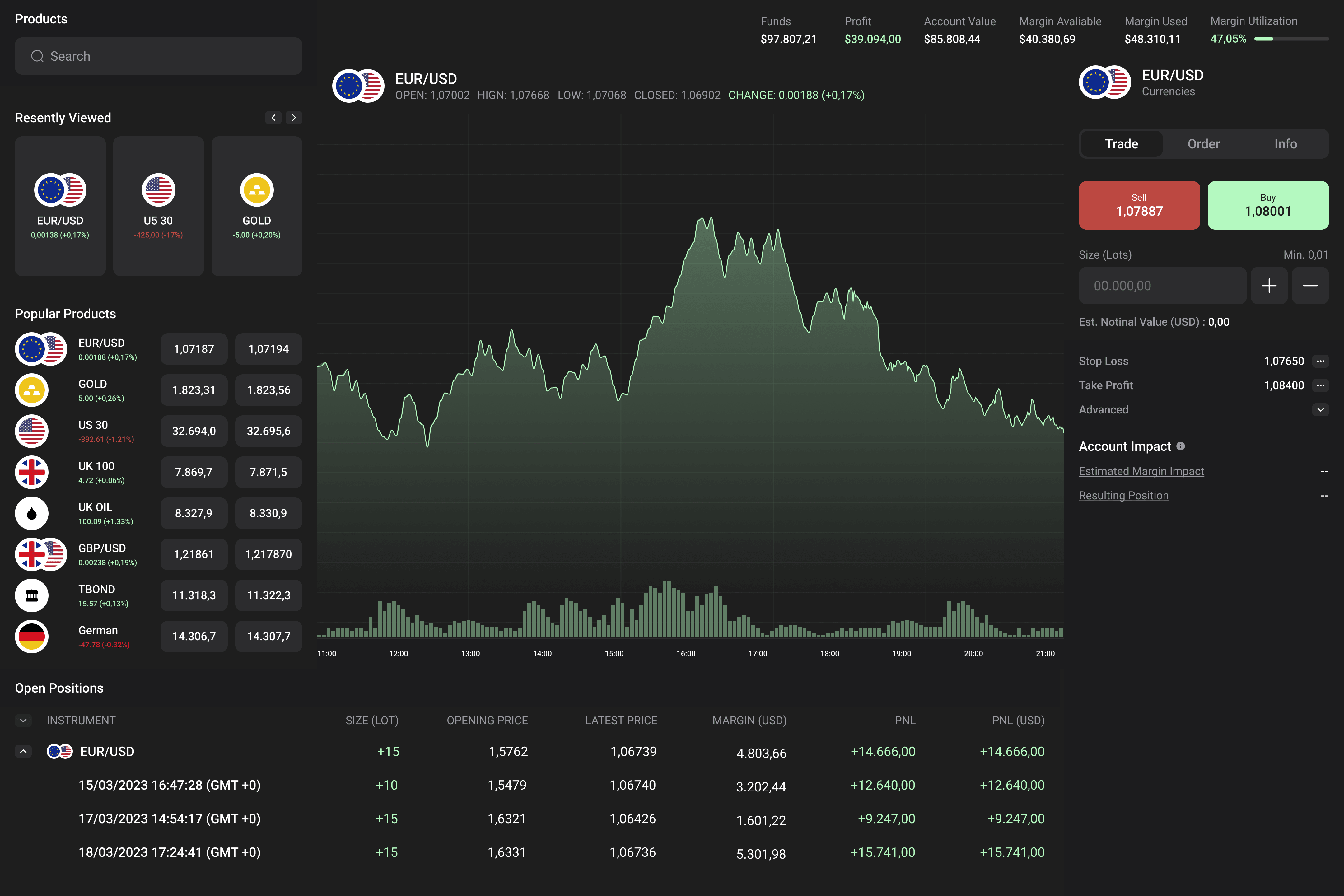

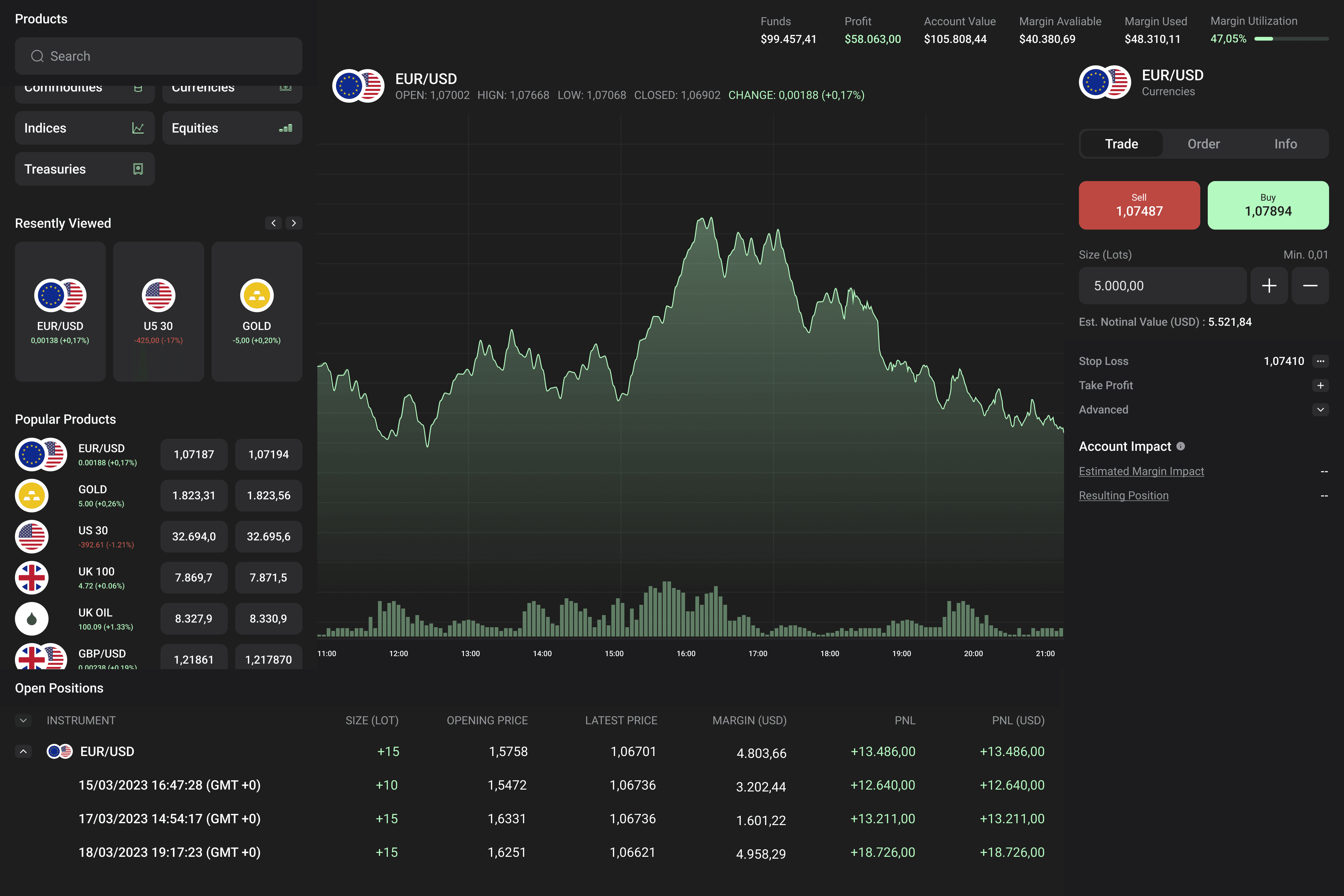

The 4x Strategy software as a service utilizes Foreign Exchange (FOREX) high-frequency trading algorithms to trade currency QuadraX Fund S.C.Sp. QuadraX Fund S.C.Sp implements a systematic trading strategy primarily focused on the EUR/USD currency pair. In addition to its core forex exposure, the Fund may also take occasional discretionary positions into commodities such as oil and gold. All trading activities are conducted exclusively through regulated brokerage partners. Professional Investors Only (MiFID II Annex II). Not for retail distribution. This website does not constitute investment advice or a public offering

our goal

Let Technology Pave The Way

Key Advantages of our 4x Strategy Software

01.

Strategy Development

02.

Market Analysis

03.

Signal Generation

04.

Automated Trade Execution

05.

Low Latency

06.

Transparent Real Time Analytics

07.

Risk Management

08.

Monitoring and Adjustment

09.

Backtesting and Optimization

4x Strategy System

4x Strategy System

4x Strategy System

4x Strategy System

4x Strategy System

4x Strategy System

4x Strategy System

4x Strategy System

4x Strategy System

Automated Trading Software

Strategy Development

Market Analysis

Signal Generation

Trade Execution

Risk Management

Monitoring and Adjustment

Backtesting and Optimization

Disclamer

Automated software, commonly known as forex trading algorithms and expert advisors (EAs), are computer programs designed to analyze the forex market and execute trades on behalf of traders. These software applications use pre-defined algorithms and trading strategies to identify potential trading opportunities and make trading decisions without direct human intervention.

Forex trading algorithms are created by programmers and traders who develop specific trading strategies or algorithms. These strategies can be based on various technical indicators, patterns, or fundamental analysis.

The automated software continuously monitors the forex market, collecting real-time data on the EUR/USD currency pair, price movements, and other relevant market information. It analyzes this data based on the programmed strategy to identify potential trade setups.

When the software identifies a trading opportunity that aligns with the programmed strategy, it generates buy or sell signals. These signals are based on specific conditions or criteria set by the trader or the software developer.

Once a trading signal is generated, the automated software automatically executes the trade on the trader's behalf. It sends the order to the broker's trading platform, specifying the currency pair, trade size, and other relevant parameters.

Forex trading algorithms usually incorporate risk management features to help protect the trader's capital. These features can include setting stop-loss orders to limit potential losses or implementing trailing stops to lock in profits as the trade moves in the desired direction.

The software continuously monitors the open trades, tracking price movements and market conditions. Depending on the programmed strategy, it may adjust stop-loss levels, take-profit targets, or even close trades entirely when certain conditions are met.

Prior to deployment, the automated software is backtested using historical market data to evaluate its performance. Traders may also optimize the software by adjusting its parameters and settings to maximize its effectiveness.

It's important to note that while automated software in most cases potential benefits, such as speed and consistency in executing trades, it is not guaranteed to be profitable. Market conditions can change rapidly, and past performance does not guarantee future results. A crucial part of the 4x Strategy teams role is monitor and review the performance of our automated software regularly and be prepared to intervene and make adjustments as required. Despite the excellent history of operations, it is important to emphasize that past performance does not mean similar in the future. Variable income is any type of investment that does not guarantee either a fixed gain or the return of the total invested.

Accounts

Information for professional investors QuadraX Fund S.C.Sp Overview of Indicative investment terms

For information purposes only. Not an offer or solicitation. Access limited to professional investors (MiFID II Annex II).

Investment Strategy

/ 01

- Investment Amount: $150,000 - $5,000,000

- Subscription Fee: 2% of Investment Amount

- Performance Fee: 40%

Investment Strategy

/ 02

- GP Annual Management Fee: 1%

- Withdrawal Fee: 0%

have a qustions?

Frequently Asked Questions

01/

What is QuadraX Fund S.C.Sp

QuadraX Fund S.C.Sp implements a systematic trading strategy primarily focused on the EUR/USD currency pair. In addition to its core forex exposure, the Fund may also take occasional discretionary positions including but not limited to equity indices such as NAS100 and commodities such as oil and gold.

02/

Governing Law and Jurisdiction

Grand Duchy of Luxembourg

QuadraX Fund S.C.Sp (Class A Units)

Registry number: B296599

LEI: 8945007DAFKL20GVBE96

03/

QuadraX Fund S.C.Sp Structure

QuadraX Fund S.C.Sp, a Special Limited Partnership (Société en Commandite Spéciale) (the “Partnership” or the “SLP” or the “Fund”) incorporated under the laws of the Grand Duchy of Luxembourg, having its registered office at 1 Haaptstroos, 9806 Hosingen, Luxembourg (the "Partnership").

04/

Intended Investor

The Fund is intended for Professional Investors as defined under Directive 2014/65/EU (MiFID II). It is suitable for investors who possess the necessary experience and knowledge to understand the risks involved in investing in complex financial instruments and alternative investment strategies.

05/

What are the risks and what could I get in return

The QuadraX Fund S.C.Sp is subject to a moderate to high level of risk, due to its exposure to a wide range of global asset classes and its potential use of leverage. These factors may result in significant price volatility and fluctuations in the Fund’s Net Asset Value. While the Fund employs diversification and risk management procedures, including the use of analytics and monitoring tools, there is no guarantee that these measures will prevent losses. Investors may experience periods of both positive and negative performance, and there is a risk of partial or total capital loss. The return profile is uncertain and depends on market developments and the performance of the Fund’s underlying strategies.

06/

Holding Period and Withdrawals

The Fund is structured as an open-ended investment vehicle with a mandatory minimum holding period (lock-in) of 30 calendar days from the date of subscription. Following this period, investors may submit redemption requests on a monthly basis.

07/

Appointed Fund Manager

DHF Asset Management S.à r.l., a private limited liability company (société à responsabilité limitée), having its registered office at 1 Haaptstrooss, Hosingen, 9806 Grand Duchy of Luxembourg, and registered with the Luxembourg Trade and Companies Register (Registre de Commerce et des Sociétés or RCS) under number B265876 has been appointed as Manager for different limited partnership agreements, but not limited to, with theLimited partners of the QuadraX Fund S.C.Sp.

08/

How do I get started

Request an application from your QuadraX Fund S.C.Sp onboarding specialist or "learn more" on https://4xstrategy.com/.